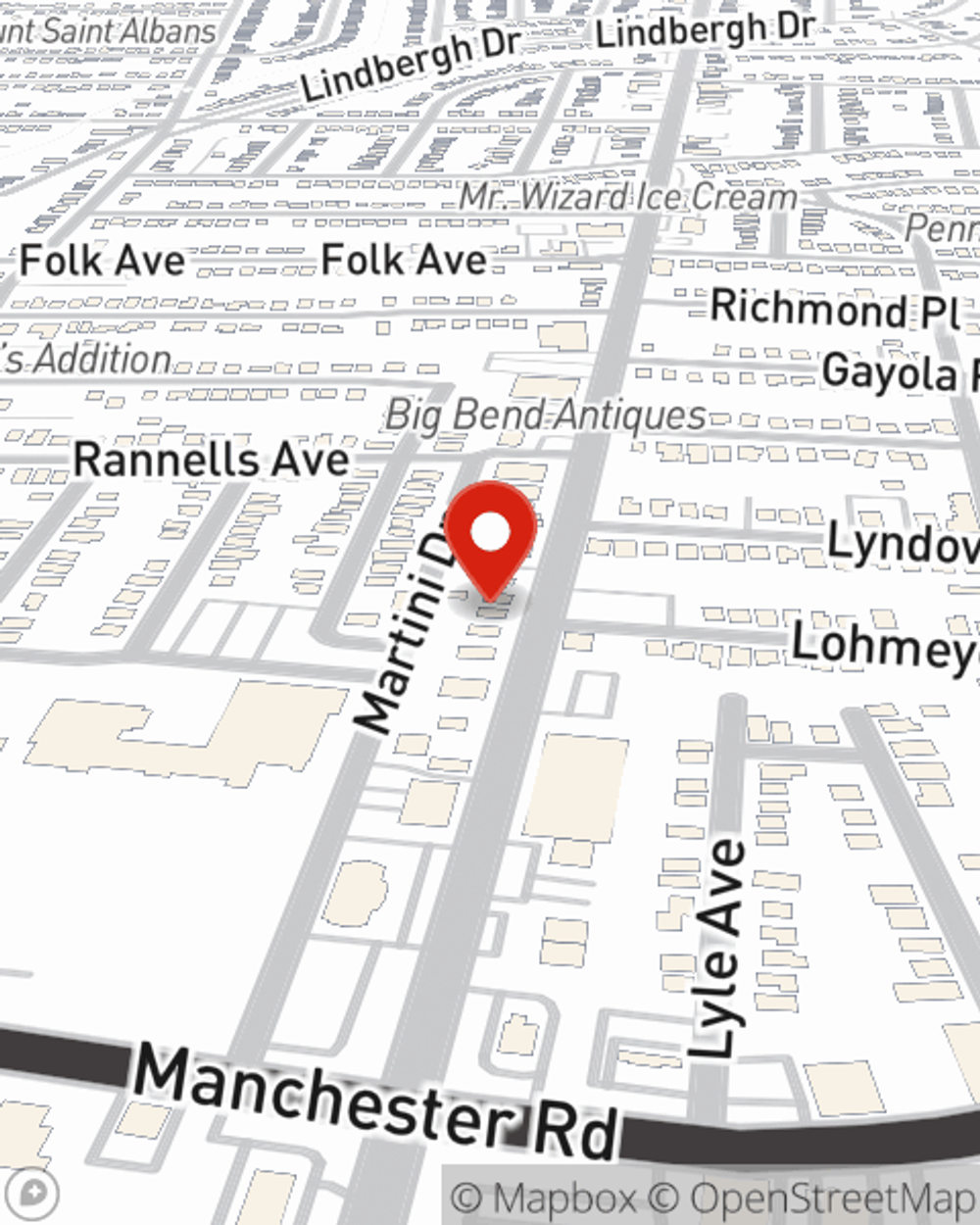

Life Insurance in and around Maplewood

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Maplewood

- Dogtown

- St. Louis City

- St. Louis County

- Brentwood

- Clayton

- University City

- Central West End CWE

- Tower Grove

- The Grove

- Midtown

- Soulard

- Webster Groves

- Kirkwood

- The Hill

- Shrewsbury

- Affton

- St. Louis Hills

- St Charles

- O'Fallon

- St. Peters

- Maryland Heights

- Wentzville

It's Time To Think Life Insurance

Young people often assume they don’t need life insurance right now. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Maplewood, MO, friends and neighbors both young and old already have State Farm life insurance!

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Why Maplewood Chooses State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years coverage for a specific time frame or another coverage option, State Farm agent Lacey Mitchell can help you with a policy that can help cover your loved ones.

If you're a person, life insurance is for you. Agent Lacey Mitchell would love to help you explore the variety of coverage options that State Farm offers and help you get a policy that works for you and the ones you love most. Contact Lacey Mitchell's office to get started.

Have More Questions About Life Insurance?

Call Lacey at (314) 899-0633 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Lacey Mitchell

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.